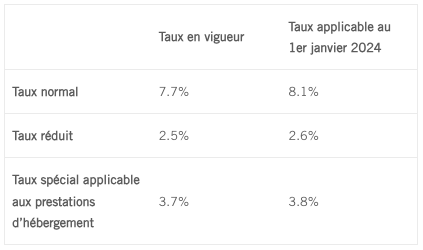

Following the adoption by the Swiss people of the “AVS 21” project on September 25, 2022, VAT rates in Switzerland are being raised to cover the expected deficit in the AVS. In addition to updating IT systems, the impact on pricing policy needs to be carefully analyzed in terms of cost structure. Contracts and rates must be adapted accordingly, and communicated transparently to customers. Particular attention must be paid to the invoicing of services provided at the end of the year. In the event of a tax increase, neither the date of invoicing nor the date of payment is decisive.

Only the time or period during which the service is provided should be taken into consideration.

Services provided up to December 31, 2023 are taxed at the old rates, while those provided from January 1, 2024 onwards are taxed at the new rates. The question of which rate to apply arises in particular for subscription-based service contracts (e.g. maintenance). For example, for a contract running from July 1, 2023 to June 30, 2024, half should be invoiced at 7.7% and the other half at 8.1%. If such invoices have already been issued, corrections for the first half of 2024 should be made using the new rate. Alternatively, the invoices may be left uncorrected, provided that the correct rate of sales is declared in the 2024 statement. In fact, the additional VAT cost could turn out to be more attractive than the administrative burden involved.

Overview of the amendment to Art. 25 of the Value Added Tax Act (LTVA)

This publication contains general information and is not a substitute for detailed research or expert advice. No liability can be accepted for its content. For specific questions, please contact the author.